When I look at Amazon’s stock today, I can’t help but wonder what it might be worth in 2040. Will it continue its remarkable growth trajectory, or will new challenges emerge? As someone who’s been following the markets for years, I find long-term predictions fascinating, even if they’re inherently speculative.

In this article, I’ll share my amazon stock price prediction 2040 analysis, examining current performance, growth projections, industry trends, and potential risks. I’ll approach this from both conservative and aggressive growth perspectives to give you a comprehensive picture of what might be possible for this tech giant.

Current Amazon Stock Performance and Historical Context

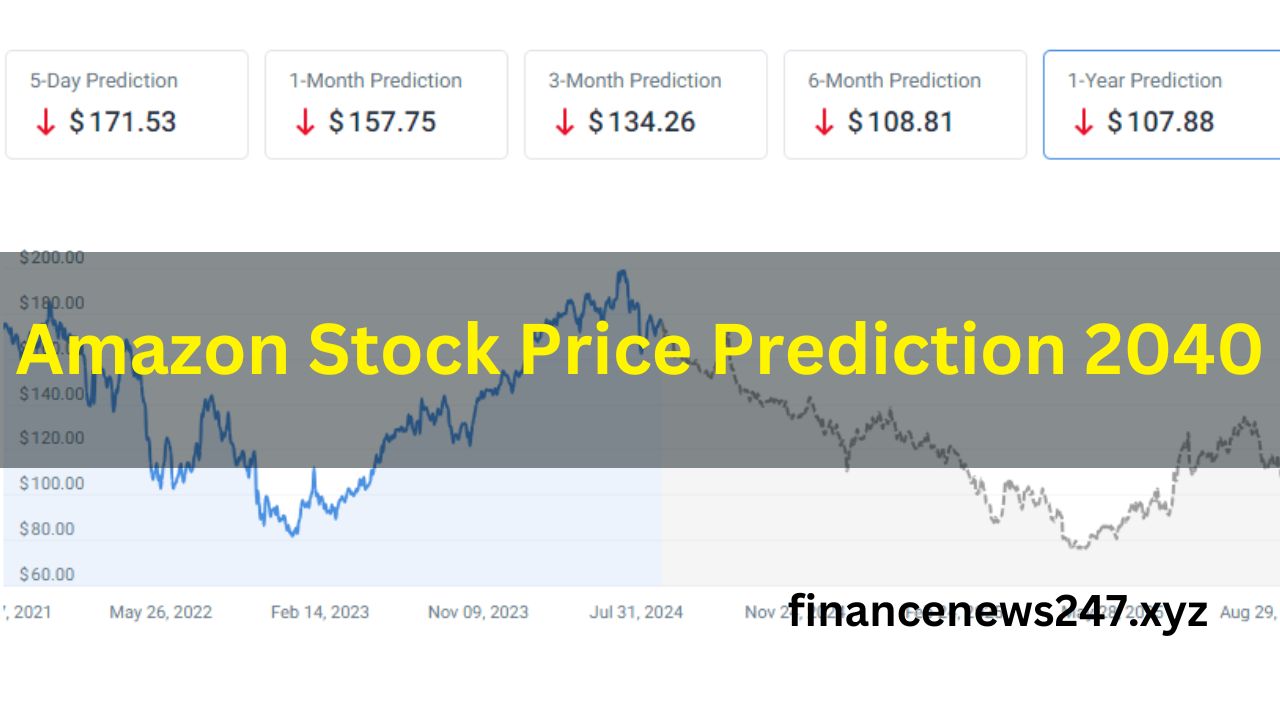

Before diving into future predictions, I need to establish where amazon stock stands today. As of April 3, 2024, Amazon was trading at $181.76, showing a significant daily decline of 7.27%. The stock has had a challenging year so far, with a YTD return of -17.15%. Looking at the bigger picture, AMZN has traded between $151.61 and $242.52 over the past 52 weeks, with a current market capitalization of approximately $1.926 trillion.

I’ve been following amazon stock for years, and one thing I’ve learned is that short-term volatility doesn’t necessarily reflect long-term potential. Amazon has consistently demonstrated an ability to recover from downturns and continue its upward trajectory.

When analyzing amazon stock, I always consider the company’s diverse business segments – North America retail, International retail, and Amazon Web Services (AWS) – which provide multiple growth avenues.

What impresses me most about Amazon is its diversified business model. Beyond its core e-commerce operations, the company has built substantial revenue streams from advertising, subscription services, electronic device manufacturing, and media content production. This diversification gives me confidence in its long-term prospects, despite any short-term market fluctuations.

Why AMZN Stock Has Tremendous Growth Potential

AMZN stock has consistently outperformed market averages over the long term, and I believe this trend could continue through 2040. The company’s relentless focus on innovation, customer experience, and operational efficiency creates a powerful foundation for future growth.

When I examine Amazon’s historical performance, I see a company that has repeatedly defied expectations. From its humble beginnings as an online bookstore to becoming one of the world’s most valuable companies, Amazon has demonstrated an exceptional ability to identify and capitalize on new market opportunities. The volatility we sometimes see in AMZN stock doesn’t change my bullish long-term outlook.

I believe AMZN stock has tremendous room for growth in the coming decades, particularly as the company continues to expand its cloud computing services, artificial intelligence capabilities, and global e-commerce presence.

Amazon’s willingness to invest heavily in future growth, often at the expense of short-term profits, has proven to be a winning strategy that I expect will continue to drive long-term value creation.

From Now to Then: Amazon Stock Prediction 2030 as a Milestone

Before looking at 2040, let’s consider a reasonable amazon stock prediction 2030 as a milestone. This intermediate checkpoint can help validate my longer-term forecasts and provide a more tangible reference point.

Based on expert consensus, most amazon stock prediction 2030 analyses suggest a price point around $403, representing 142% growth from current levels. This projection assumes continued expansion in Amazon’s core businesses, successful integration of AI technologies, and effective management of competitive and regulatory challenges.

I use Amazon stock prediction 2030 as a checkpoint to validate my longer-term forecasts. If Amazon can achieve this intermediate milestone, it would demonstrate that the company remains on a strong growth trajectory, making more ambitious 2040 projections more plausible.

Expert Amazon Stock Forecast 2040: Comparing Different Scenarios

When creating an Amazon stock forecast for 2040, I consider both internal company factors and broader economic trends. Let me walk you through different scenarios based on varying growth assumptions.

In a conservative growth scenario, I apply the S&P 500’s historical average return of approximately 11.47% annually. This approach yields a projected 2040 price of around $1,200 per share, representing a 510% increase from current levels. While this might seem substantial, it represents a relatively modest growth rate for Amazon given its historical performance.

My amazon stock forecast 2040 takes into account technological innovations that will reshape the market. Under a more aggressive growth scenario, applying the NASDAQ-100 Technology Sector’s historical performance of 16.19% annually, the projected 2040 price jumps to approximately $2,236 per share. This represents a dramatic increase that would solidify Amazon’s position as one of the world’s most valuable companies.

The most optimistic amazon stock forecast 2040 suggests a price exceeding $2,200 per share, but I believe even this might be conservative if Amazon continues to innovate and expand into new markets successfully. The company’s history suggests it could potentially outperform even these aggressive projections.

Factors Affecting Long-Term Amazon Stock Prediction

Any long-term amazon stock prediction must account for the company’s history of reinvention and adaptation to changing market conditions. Several key factors will likely influence Amazon’s performance through 2040:

- AI and Cloud Computing Evolution: The potential annual economic value addition of $4.4 trillion globally through generative AI represents a massive opportunity for Amazon. As AWS continues to evolve, I expect it to capture a significant portion of this growing market. By 2040, AI capabilities are expected to achieve human-level performance in many technical areas, potentially transforming Amazon’s operations across all business segments.

- Edge Computing and Data Processing: I’m particularly interested in how Amazon will leverage edge computing technologies to enhance real-time data processing capabilities. This could dramatically improve the efficiency of its logistics operations, customer recommendations, and overall user experience.

- Global E-commerce Expansion: Despite its already massive presence, Amazon still has substantial room for growth in international markets. I base my long-term amazon stock prediction on Amazon’s consistent ability to enter and dominate new markets, adapting its approach to local conditions while maintaining its core customer-centric philosophy.

- Healthcare and Pharmaceutical Ventures: Amazon’s moves into healthcare, including its acquisition of One Medical and launch of Amazon Pharmacy, could open entirely new revenue streams by 2040. The healthcare industry represents a multi-trillion-dollar opportunity that could significantly boost Amazon’s growth trajectory.

The most reliable long-term Amazon stock prediction methods consider multiple growth scenarios and the company’s demonstrated ability to create entirely new business categories. I believe Amazon’s culture of innovation and willingness to experiment will continue to drive growth through 2040 and beyond.

Risks to Consider in My Amazon Stock Analysis 2040

While I’m generally optimistic about Amazon’s long-term prospects, my amazon stock analysis 2040 wouldn’t be complete without addressing potential risks and challenges:

- Regulatory Pressures: Amazon faces increasing antitrust scrutiny in the U.S. and Europe. By 2040, regulatory actions could potentially force structural changes to the company, including possible breakups or significant operational restrictions. These regulatory challenges represent perhaps the most significant threat to my growth projections.

- Competitive Landscape: The competitive environment will undoubtedly evolve over the next two decades. Companies like Walmart, Alibaba, and Microsoft are investing heavily to challenge Amazon in its core markets. Maintaining market leadership across multiple segments will require continued innovation and adaptation.

- Operational Risks: As Amazon grows, managing its vast operations becomes increasingly complex. Resource management challenges, talent retention issues, and dependencies on third-party partners could all impact performance. The company will need to continue refining its operational capabilities to maintain efficiency at an ever-larger scale.

- Technological Disruption: While Amazon has historically been a disruptor, it could potentially find itself disrupted by new technologies or business models. Staying ahead of technological change will be crucial to maintaining its competitive advantage through 2040.

Despite these risks, I remain confident in Amazon’s ability to navigate challenges and continue creating shareholder value. The company’s track record of adaptation and reinvention gives me faith in its long-term resilience.

My Personal Prediction for Amazon Stock in 2040

After analyzing all available data and considering multiple growth scenarios, my personal amazon stock price prediction 2040 lands somewhere between the conservative and aggressive projections. I believe a price range of $1,500-$2,000 per share is reasonable, representing approximately 725%-1000% growth from current levels.

This prediction assumes that Amazon will successfully navigate regulatory challenges, continue to innovate across its business segments, and maintain its customer-centric approach. I expect AWS to remain a primary growth driver, with AI and edge computing capabilities creating substantial new value.

The e-commerce business will likely continue to expand globally, while new ventures in healthcare, financial services, and other sectors could provide additional growth catalysts.

While this prediction represents significant growth, I believe it’s actually conservative given Amazon’s historical performance and future potential. The company has repeatedly demonstrated an ability to exceed expectations and create entirely new markets. If Amazon continues this pattern through 2040, my prediction could prove to be too modest.

Conclusion: The Future of Amazon Stock

When I consider all factors affecting amazon stock price prediction 2040, I remain optimistic about the company’s long-term prospects. Despite inevitable challenges and periods of volatility, Amazon’s culture of innovation, customer obsession, and willingness to invest for the future position it well for continued success.

While no prediction can be made with certainty, especially one looking 16 years into the future, the analysis suggests that Amazon will likely continue to reward patient, long-term investors. As with any investment, diversification remains important, but I believe Amazon deserves consideration as a core holding in growth-oriented portfolios with a long time horizon.

Frequently Asked Questions

What is the most conservative amazon stock price prediction for 2040?

Based on the S&P 500’s historical average return of 11.47%, a conservative prediction would be approximately $1,200 per share, representing a 510% increase from current levels.

Could Amazon’s stock price reach $2,000 by 2040?

Yes, I believe it’s entirely possible. Under more aggressive growth scenarios based on the NASDAQ-100 Technology Sector’s historical performance, Amazon could reach approximately $2,236 per share by 2040.

What are the biggest risks to Amazon’s stock growth through 2040?

The most significant risks include regulatory challenges (potential antitrust actions), increasing competition in core markets, operational complexities as the company grows, and the possibility of technological disruption.

How might AI impact Amazon’s stock performance by 2040?

AI represents a massive opportunity for Amazon, potentially adding significant value through enhanced cloud services, improved operational efficiency, and new product offerings. By 2040, AI is expected to achieve human-level performance in many technical areas, which could dramatically transform Amazon’s business.

Is Amazon stock a good long-term investment for retirement portfolios?

While individual investment decisions should be based on personal circumstances and goals, Amazon’s strong historical performance and diverse growth prospects make it worth considering as part of a diversified retirement portfolio, particularly for investors with a long time horizon.

How reliable are stock predictions for 2040?

Long-term stock predictions inherently involve significant uncertainty. They should be viewed as educated projections based on current information rather than guarantees. Many unforeseen factors could impact actual performance, so it’s important to regularly reassess and adjust expectations as new information becomes available.