HDFC Share Price History: Have you ever wondered what makes HDFC one of India’s most watched stocks? Whether you’re a seasoned investor or just curious about the financial markets, the HDFC share price history tells a fascinating story of growth, resilience, and transformation in India’s banking sector.

Looking at HDFC’s share price history gives us valuable insights into the company’s growth trajectory over the decades. From its humble beginnings to becoming a banking powerhouse, HDFC’s journey on the stock market reflects India’s economic evolution. Let’s dive into this journey together and uncover the factors that have shaped one of India’s most prominent financial institutions.

The Early Years: Foundation of a Financial Giant

HDFC (Housing Development Finance Corporation) wasn’t always the banking behemoth we know today. When we look at the HDFC share price history, we need to start from its roots. The company was established in 1977 as India’s first specialized mortgage company, filling a crucial gap in the housing finance sector.

In its early years, HDFC focused primarily on providing housing loans, a relatively untapped market in India at that time. This unique positioning gave the company a first-mover advantage that would later translate into significant share price appreciation.

The HDFC share price history reflects the company’s resilience during various economic cycles, even in its formative years. While specific share price data from the earliest period isn’t readily available in our research, what we do know is that the company laid a solid foundation based on prudent lending practices and strong corporate governance principles that would later attract significant investor interest.

By the 1990s, as India began liberalizing its economy, HDFC was already well-positioned to capitalize on the growing housing finance market. This period marked the beginning of HDFC’s expansion beyond its core housing finance business, setting the stage for its remarkable growth story that would unfold in the coming decades.

Major Milestones and Their Impact on HDFC Share Price

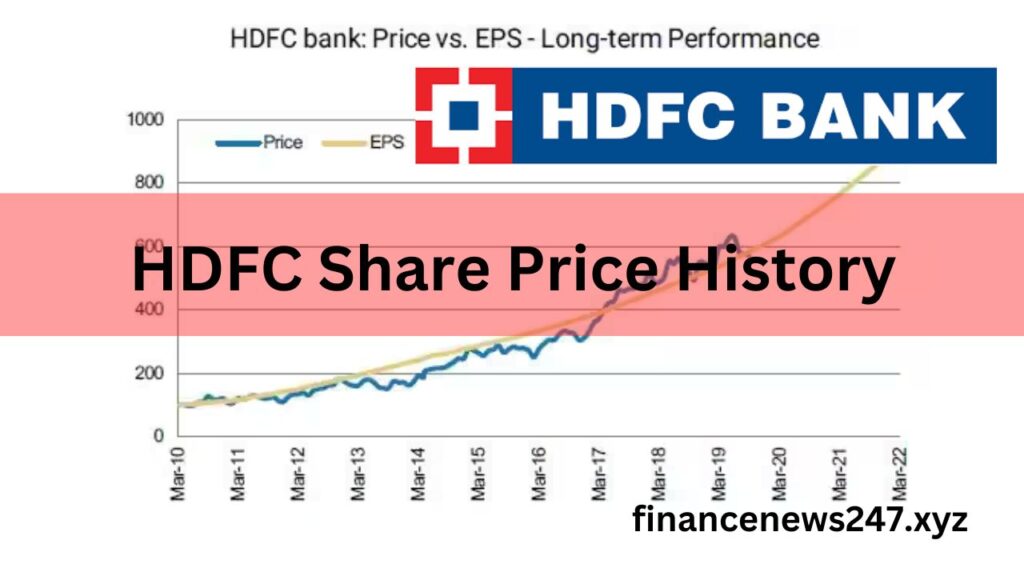

Studying HDFC share price history helps investors understand the impact of key corporate decisions on the company’s valuation. Several pivotal moments stand out when analyzing the HDFC bank share price history through key milestones.

One of the most significant events was the establishment of HDFC Bank in 1994, as part of the RBI’s efforts to liberalize the Indian banking sector. This strategic move expanded HDFC’s footprint in the financial services industry. While HDFC and HDFC Bank operated as separate entities for decades, their destinies remained intertwined, with HDFC maintaining a significant stake in HDFC Bank.

The HDFC bank share price history shows significant appreciation since its listing on the stock exchange. From its IPO price, the stock has delivered remarkable returns to long-term investors. This growth wasn’t just coincidental – it was backed by strong fundamentals, innovative banking practices, and strategic expansion.

Looking at a detailed HDFC share price history chart shows clear patterns of growth despite market volatility. The stock has weathered multiple economic storms, including the 2008 global financial crisis. During this period, while many banking stocks worldwide tumbled, HDFC demonstrated remarkable resilience, reinforcing investor confidence in its business model and risk management practices.

The factors that have influenced HDFC share price over the years include:

- Consistent financial performance with loan book growth at an impressive 5-year CAGR of 19.71%

- Strong asset quality with relatively low NPAs compared to industry peers

- Strategic expansions and acquisitions that broadened its market presence

- Robust dividend history, making it attractive to income-focused investors

- High institutional ownership, with FIIs holding 48.30% and DIIs holding 35.64% of shares

Analyzing HDFC bank share price history reveals several periods of consolidation followed by breakouts, typically coinciding with positive corporate announcements or strong quarterly results.

The Historic Merger: A New Chapter in HDFC Share Price History

Perhaps the most transformative event in recent HDFC share price history was the announcement of the HDFC-HDFC Bank merger. On April 4, 2022, HDFC and HDFC Bank announced their decision to merge, creating what would become one of the world’s largest banks by market capitalization.

The merger announcement had an immediate effect on the HDFC bank share price. Markets initially responded positively to the news, recognizing the potential synergies and growth opportunities the combined entity would offer.

The merger, which became effective from July 1, 2023, represented the largest transaction in India’s corporate history with several key implications:

- The share swap ratio was set at 42 shares of HDFC Bank for every 25 shares of HDFC

- The combined entity reached a market capitalization of approximately ₹14.73 lakh crore

- The merger created a banking powerhouse with a combined capital adequacy ratio of 24.3%

- Both entities brought strong asset quality to the table, with gross NPAs at 1.18% for HDFC and 1.12% for HDFC Bank

How the merger affected HDFC bank share price is a study in market expectations and reality. While there was initial enthusiasm, the stock experienced some volatility as investors digested the implications of this massive corporate restructuring. The HDFC share price trends over time following the merger announcement reflected both optimism about long-term prospects and short-term concerns about integration challenges.

The merger significantly increased the combined entity’s weight in the Nifty index, projected to rise to about 15%, making it impossible for index funds and many active managers to ignore. This structural demand for the stock has important implications for its future price movements.

Recent Performance and Current Market Position

The HDFC bank share price has consistently outperformed many of its peers in the banking sector over the long term. As of recent data, HDFC Bank trades at approximately ₹1,765.00 on the NSE, with a market capitalization of around ₹13,50,617 crore.

When we examine HDFC share price historical data reveals interesting patterns during economic downturns and recoveries. The stock reached a recent high of ₹1,865.20 on December 16, 2024, and has been trading within a 52-week range of ₹1,426.80 to ₹1,880.00.

Performance metrics tell an interesting story:

- 1-Month Return: +4.48%

- 1-Year Return: +13.98%

- 3-Year Return: +16.53%

However, it’s worth noting that despite these positive returns, the stock has actually underperformed compared to broader market indices. The HDFC share price has lagged behind both the Nifty 100 (which returned 25.37%) and the Nifty Bank (which returned 32.07%) over comparable periods.

Factors like interest rate changes and regulatory policies have impacted the HDFC share price in recent times. The banking sector as a whole has faced challenges from changing regulatory requirements and economic uncertainties, which have occasionally weighed on HDFC’s share price.

Technical analysts often study the HDFC share price history chart to identify potential entry and exit points. The stock has shown some interesting technical patterns, with periods of consolidation followed by breakouts, offering opportunities for both long-term investors and shorter-term traders.

What Does HDFC Share Price Historical Data Tell Us About Valuation?

Investors can gain valuable insights by analyzing HDFC share price historical data alongside key corporate announcements and financial metrics. Current valuation metrics include:

- P/E Ratio: 19.41

- Dividend Yield: 1.10%

- Price-to-Book Ratio: 2.82

These figures suggest that while HDFC Bank isn’t cheap by traditional valuation metrics, investors are willing to pay a premium for its quality, growth prospects, and market position.

The long-term HDFC share price trends over time reflect the company’s consistent financial performance. Despite occasional periods of underperformance, the overall trajectory has been positive, rewarding patient investors with substantial returns.

Understanding HDFC share price trends over time can help investors identify buying opportunities, particularly during market corrections when quality stocks like HDFC may trade at more attractive valuations.

Expert Outlook and Future Prospects

Analysts continue to provide positive forecasts for the HDFC bank share price, with current analyst coverage showing:

- Strong Buy: 18 analysts

- Buy: 13 analysts

- Hold: 6 analysts

- Mean Target Price: ₹2,000

- Price Range: ₹1,627 – ₹2,660

These projections suggest potential upside from current levels, though opinions vary on the magnitude of expected returns.

Many investors closely monitor the HDFC share price as a barometer for the Indian financial sector. As one of India’s largest and most respected financial institutions, HDFC’s performance often reflects broader trends in the economy and banking sector.

The HDFC share price historical data shows how the stock has responded to various market cycles, typically demonstrating resilience during downturns and strong performance during economic expansions. This pattern gives investors confidence in the stock’s ability to weather future market volatility.

Post-merger, the combined entity faces both opportunities and challenges:

- Opportunities include cross-selling potential, expanded customer base, and economies of scale

- Challenges involve integration complexities, regulatory compliance, and competitive pressures

Investors who understand HDFC Bank’s share price history can make more informed decisions about the stock’s future potential. The bank’s strong fundamentals, market position, and growth prospects continue to make it an attractive option for many investors looking for exposure to India’s financial sector.

Conclusion: Lessons from HDFC’s Market Journey

The HDFC share price history tells a compelling story of a company that has consistently evolved with changing market dynamics while maintaining its core strengths. From its origins as a specialized housing finance company to becoming part of one of India’s largest banks, HDFC has demonstrated remarkable adaptability and vision.

For investors, the HDFC journey offers several valuable lessons:

- Quality businesses tend to create shareholder value over the long term

- Strategic corporate actions like mergers can unlock significant value

- Companies with strong fundamentals can weather economic storms better than their peers

- Patient investors who look beyond short-term volatility are often rewarded

Whether you’re considering an investment in HDFC Bank or simply interested in understanding one of India’s financial success stories, the HDFC share price history provides a fascinating case study in corporate evolution and value creation.

As India’s economy continues to grow and evolve, HDFC Bank remains well-positioned to capitalize on opportunities in the financial services sector. While past performance is never a guarantee of future results, the company’s track record suggests it has the fundamentals, management expertise, and market position to continue its growth story in the years ahead.

The next time you check the HDFC bank share price, remember that behind that number lies decades of strategic decisions, market cycles, and the collective judgment of millions of investors – all part of a continuing story that remains one of the most watched in India’s financial markets.

Also Read: How to Get a Personal Loan from MoneyView: Step-by-Step Guide (2025)